Barchart Wheat Price Indexes

wheat Price Indexes by State

Barchart Wheat Price Index Family

Get Free Daily Price ReportThe Barchart Wheat Price Index family is a series of volume weighted indexes and price assessments that represent fair value pricing for physical Wheat across the United States. The indexes are calculated on a continuous basis and use a sophisticated – but transparent - weighting process to ensure prices are objective and reflective of underlying market economics.

Calculated at the County, Crop Reporting District, State, Regional, and National level – from prices contributed by over 4,000 grain buying locations – there are over 500 different front-month indexes. With forward curves going out twelve months for each index area there are over 6,000 objective prices for Wheat calculated each day. Historical information is available through to the start of 2014.

Major growing zones are divided among the following regions:

- Eastern – Illinois, Indiana, Kentucky, Michigan, Ohio, Wisconsin

- Western – Iowa, Kansas, Minnesota, Nebraska, N. Dakota, S. Dakota

- Delta – Arkansas, Louisiana, Mississippi, Missouri, Tennessee

The indexes are powered by best-in-class grain prices from Barchart. Additional prices, including basis values and forward curve information, are available exclusively to subscribers of cmdtyView® - the leading platform for commodity trading – or other data products available through Barchart.

Barchart Commodities Insider

Front month wheat futures fell double digits on Wednesday. For SRW, that left the market 2% to 2.6% lower as July got back near the $6 mark. KC Wheat futures ended the session 18 1/2 to 29 1/4 cents in the red with a 3.5% loss in July. Spring wheat closed with 17 1/4 to 22 3/4 cent losses of as much as 2.8%.

Ahead of the weekly FAS data, analysts are looking for USDA to report between 75k MT of old crop wheat cancelations and 100k MT of net new old crop sales. New crop export sales are estimated between 200k MT and 500k MT for the week that ended 5/18.

Ukraine’s Ag Ministry reported the season’s grain export was 4.6% behind last year’s pace with 44.6 MMT shipped – including 15.3 MMT of wheat, an 18% decrease yr/yr.

Jul 23 CBOT Wheat closed at $6.06 1/4, down 16 cents,

Sep 23 CBOT Wheat closed at $6.19, down 15 1/2 cents,

Cash SRW Wheat was $5.45 1/4, down 16 cents,

Jul 23 KCBT Wheat closed at $8.12 1/4, down 29 1/4 cents,

Cas... Read more

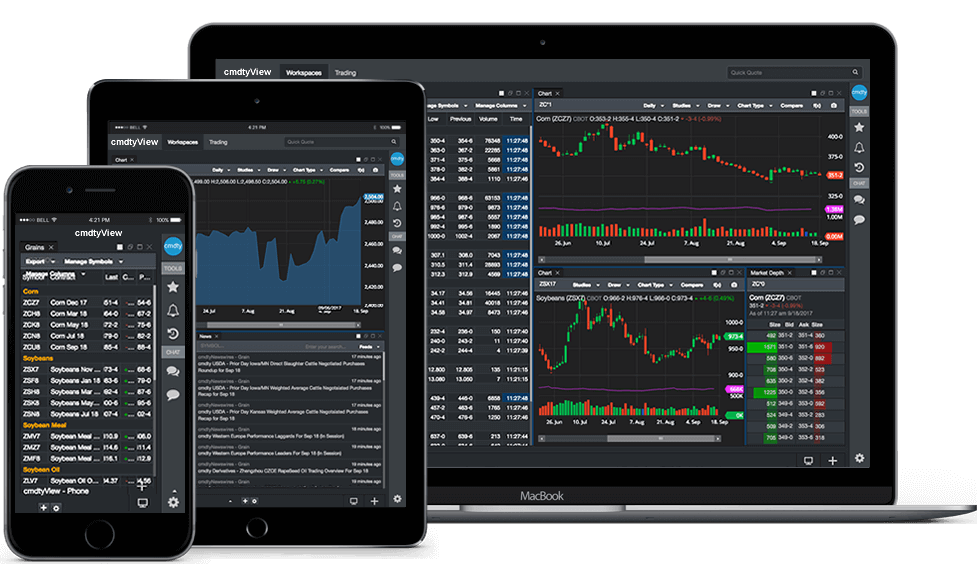

Get all of our commodity data and prices in cmdtyView.

All of our exclusive data and prices are available through the cmdtyView terminal - a fully web-based and responsive commodity trading platform that works seamlessly across all of your devices.